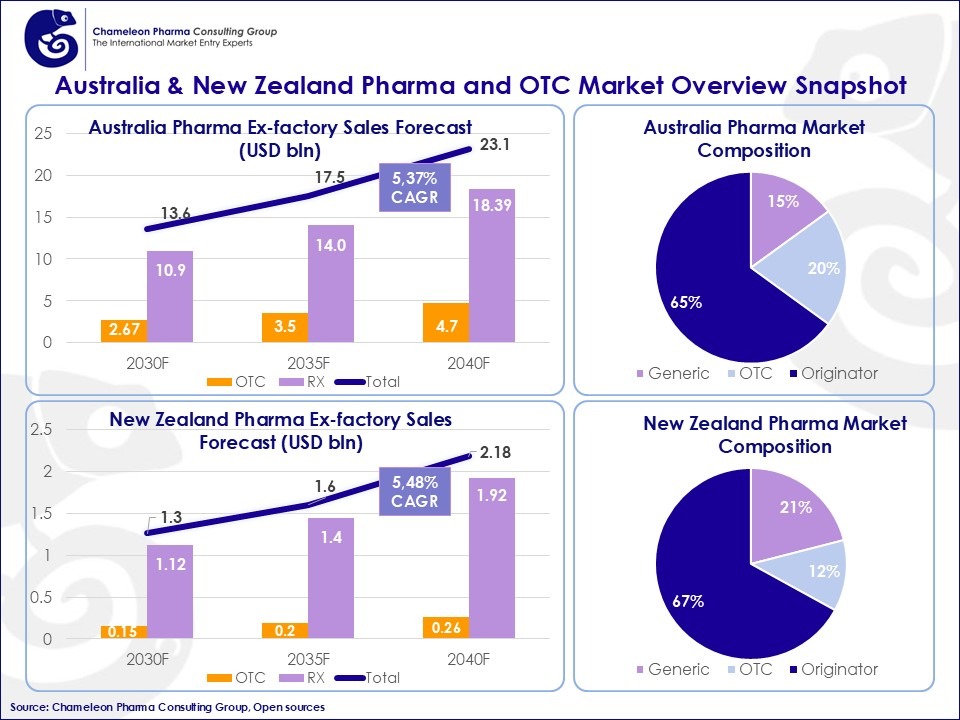

The Australia and New Zealand OTC & Rx markets are set for significant expansion, with Australia projected to surpass USD 23.1 billion by 2040 at a CAGR of 5.37%, and New Zealand expected to reach USD 2.19 billion, growing at a CAGR of 5.48%. This growth is driven by rising health awareness, increasing demand for women’s health and pregnancy food supplements and stable population growth. As more consumers prioritize prenatal and postnatal nutrition, the market offers substantial opportunities for both local and international players.

Market Overview and Total Sales (2030–2040)

The women’s health and pregnancy food supplements market in Australia and New Zealand is set to witness significant expansion between 2030 and 2040. Australia’s OTC & Rx market is projected to grow from USD 13.60 billion in 2030 to USD 23.1 billion by 2040, reflecting a CAGR of approximately 5.37%. Similarly, New Zealand’s market is expected to experience steady growth, with total sales rising from USD 1.26 billion in 2030 to USD 2.19 billion by 2040, corresponding to a CAGR of about 5.48%. This sustained upward trajectory highlights the increasing demand for health and wellness products tailored to women’s health and pregnancy in the region.

Australia and New Zealand are emerging as key players in the global women’s health care (WHC) and food supplements (FS) industry. Compared to other developed regions, their growth rates are competitive, driven by rising awareness and innovative product offerings.

Figure 1: The Australia and New Zealand Pharma and Consumer Health Market Overview

Key Market Drivers and Trends in Australia and New Zealand

Several factors drive the growth of the women’s health care and pregnancy supplement market in Australia and New Zealand:

- Rising Health Awareness: Increased education on nutrition and preventive health is boosting demand for FS and WHC products.

- Population Growth and Birth Rate: Australia’s population growth rate of 1.3% and a birth rate of 12.1 births per 1,000 people create a stable demand for pregnancy care products.

- Disposable Income: Higher disposable incomes enable consumers to prioritize health and wellness spending.

- Regulatory Support: The Australian Therapeutic Goods Administration (TGA) ensures product safety and quality, instilling consumer confidence.

- Prevalence of Health Conditions: Increased cases of urinary tract infections (UTIs) and nutritional deficiencies among women highlight the need for targeted WHC products.

Leading Companies in the Women’s Health Care Market

Both Australia and New Zealand’s WHC and pregnancy care markets feature several prominent companies:

- Blackmores: An Australian company renowned for its high-quality vitamins, minerals, and supplements (VMS), including prenatal vitamins and women’s health products. Blackmores has a significant presence in both countries.

- Swisse: Another major Australian player offering a broad range of VMS products tailored to women’s health. Swisse products are available in both Australia and New Zealand.

- Nature’s Way: Known for its innovative and affordable WHC products, Nature’s Way operates in both markets, providing a variety of supplements aimed at supporting women’s health.

Australian & New Zealand’s Pregnancy Care and Prenatal Market Insights

Both the Australian and New Zealand prenatal markets benefit from stable birth rates and consistent population growth. With an increasing number of women consulting obstetricians (OBGYN) and gynecologists for pregnancy care, the demand for high-quality prenatal vitamins and supplements is on the rise. Products addressing common pregnancy-related issues, such as iron deficiency and folic acid supplementation, dominate this segment.

Healthcare Facilities Specializing in Women’s Health

In addition to these companies, both countries have specialized healthcare facilities focusing on women’s health:

- Australia:

- Royal Women’s Hospital: Located in Melbourne, it is Australia’s oldest specialist women’s hospital, offering a full range of services in maternity, gynecology, neonatal care, women’s cancers, and women’s health.

- Royal Hospital for Women: Based in Sydney, this specialist hospital provides comprehensive services for women and babies, including maternity, gynecology, and neonatal care.

- New Zealand:

- An advocacy organization dedicated to promoting women’s health issues and ensuring quality healthcare services for women.

These institutions play a crucial role in supporting women’s health and pregnancy care in their respective regions.

How CPC Supports Market Entry

Chameleon Pharma Consulting Group (CPC) has over 20 years of experience in supporting Pharma, OTC, Medical Devices, Phyto, and Aesthetic Medicine companies. Having established own offices & local hubs across Latin America, Europe, Asia, the US/Canada, the Middle East, and the CEE/CIS regions is another advantage of CPC. With this local network and expertise gained from 300+ international projects and a team of 25 experts we offer our clients:

- Business Development, M&A, and Due Diligence

- Market Entry & Expansion: Systematic product and country analysis, market reports

- Strategic Partnering: Identifying local partners, acquisitions, or setting up own offices

- Regulatory & Registration: for drugs, MD, Derma, Aesthetic Medicine, etc.

- Market Authorization & Compliance: Holding MAs, conducting pharmacovigilance

- Quality & Certification: GMP certification, pre-GMP audits

Contact us today for your individual request at service@chameleon-pharma.com!