Photo by Pulak Bhagawati on Unsplash

For more than a decade, the emerging markets of China and India have held a special promise for the global Pharma and Consumer Health industry. Driven by a combination of rapidly expanding economies, technological innovation and a talented workforce, countries in the Asia-Pacific region have seen explosive growth both economically and politically.

Home to 60% of the world’s population, Asia has become the fastest-growing pharmaceutical market in the world and offers tremendous market potential. There is a growing educated middle class interested in health issues, aging populations, and an expanding pool of talented human resources. As economic prosperity impacts the way people live, chronic and lifestyle diseases, such as diabetes and heart disease, are slowly beginning to replace infectious diseases in the majority. Coupled with the population’s increasing ability to spend more on healthcare, these factors have all helped attract pharmaceutical R&D and clinical research organizations to China and India.

With growing economies, big patient pools, increased numbers of patients with chronic diseases and regulatory bodies motivated to bring new medicines to the market, these countries could become an oasis within a growing desert of drugs going off-patent and increasing generic competition in mature markets like the US and Europe.

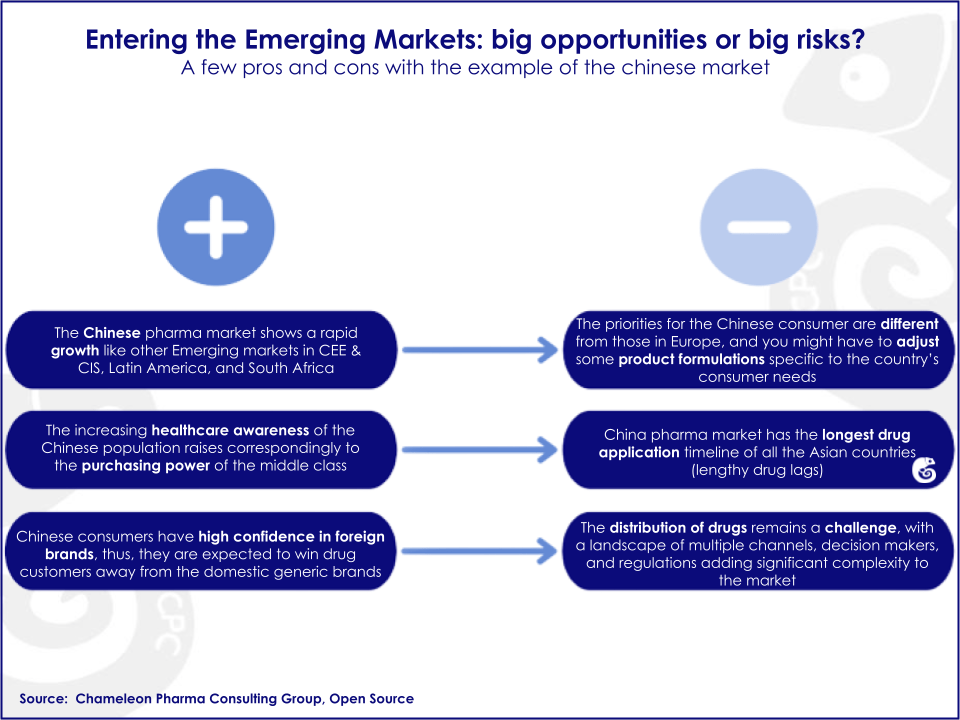

However, because China and India are two of the key growth markets for the Pharma and Consumer Health industry, understanding how their particular market structures give rise to various social challenges is paramount to entering these markets successfully and responsibly. The peculiarities of the Chinese and Indian markets set up specific challenges and opportunities for foreign drug companies in both countries.

In China, complex and bureaucratic processes surrounding drug purchasing, a high level of decentralisation and complex distribution channels all conspire to make the system sensitive to corruption and the marketing of poor-quality drugs. Regulation addressing corruption in drug marketing and quality and safety tends to be lacking or poorly enforced, but this is expected to improve in the near future.

In India, patenting and pricing issues remain a primary concern; the government maintains a commitment to ensuring an appropriate balance between IP rights and the right to health. Due to the country’s strong domestic generics industry and its status as the ‘pharmacy of the developing world’, developments in India will affect patients around the world who depend on a steady supply of cheap Indian drugs. In addition, recent controversies surrounding the treatment of participants in clinical trials have brought this issue under the regulatory spotlight.

The emerging Pharma and Consumer Health markets in the Asia-Pacific region are a valuable opportunity for foreign drug companies as they continue to generate a considerable amount of revenue, which will only continue to rise. If foreign drug companies modify their business models to accommodate local needs and the dynamic conditions of these developing markets, they can correct the errors they made in underestimating the markets’ complexities in the past and pave themselves a way for successful business in China and India in the future.