Pharma M&A Consulting

In recent years, the Pharma and Healthcare industry has gone through several huge waves of M&As. Big multinational corporations have found mutual advantages in mergers and acquisitions, which were estimated at billions of U.S. dollars in total. At its core, acquisitions and mergers might be highly profitable activities, but aside from that they can also be useful strategic movements.

Considering the increasing trends towards globalization, acquisitions can be a creative and valuable tool that can support you expand your business into emerging markets. It is not enough to engage in Pharma M&A activities with companies actively looking for buyers; sometimes, your best acquisition target has not made any public announcement. With our local expertise and up-to-date regional market knowledge, we can help you identify key strategic acquisition targets before your competitors get to know about those targets. Often the main thing with M&A is to be the first to know about the target and to avoid any bidding process, which makes targets much more expensive.

Selected Pharma M&A projects we at Chameleon Pharma have worked on

We have supported European Pharma & healthcare companies in systematically identifying product acquisition targets in Russia/CIS to avoid a bidding process with other investors.

We conducted an in-depth analysis for a top EU medical device company to identify product acquisition targets that would expand their business in key emerging markets like Asia, CIS, and Latin America.

We have consulted a top 30 global Pharma and OTC company on the identification of key product and company acquisition targets in Latin America and CIS including Russia, to successfully expand the foreign business while also minimizing competition from other investors.

We have helped a mid-sized EU cosmetics company rapidly enter the Mexico and US cosmetics market through the identification of local key product and company acquisition targets and conducting the accompanying due diligence.

Assisted a US/Canada client with establishing a firm foothold in the European and CEE/CIS (incl. Russia) Consumer, Pharma, and cosmetics market through the strategic acquisition of three local mid-sized companies and some single brands.

Supported more than five Asia-based companies to systematically identify an Rx portfolio and a small EU-GMP production plan in Europe.

Helped a CIS based Pharma company to market entry in the EU tender market and assisted in the acquisition of a sales and marketing company

How to grow your international business by smart acquisition targets

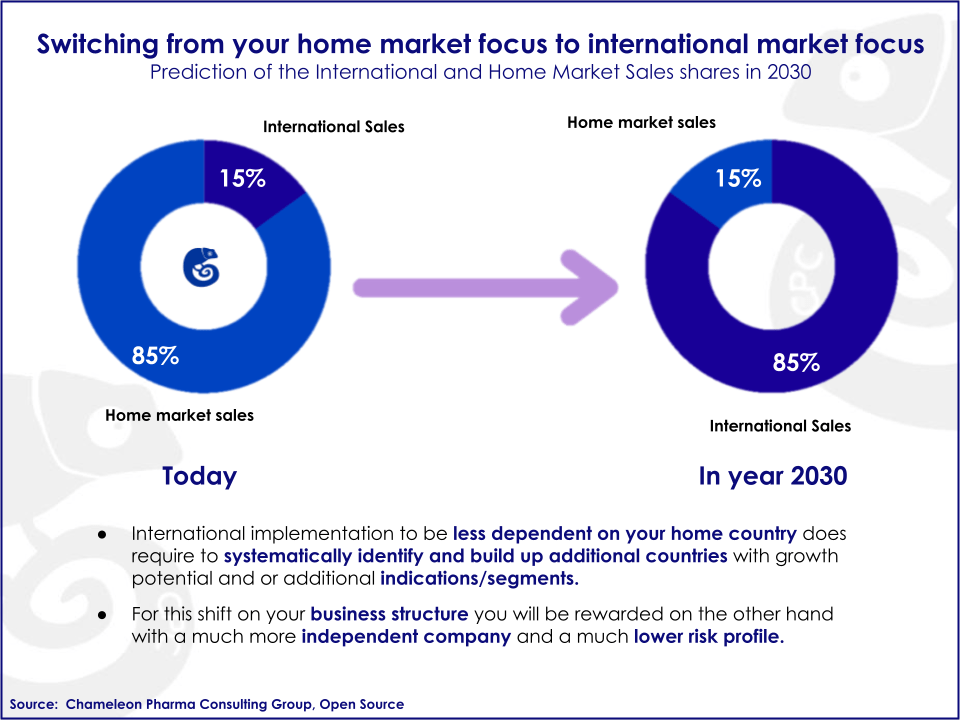

In 2030, about 45% of sales for Consumer Heath & Pharma companies will be conducted in international Emerging Markets. Introducing your own consumer health, cosmetics, Food supplements or Rx products to additional growing markets in Latin America, Russia/CIS region, Asia, Europe or the USA renders manufacturers less dependent on their home market. Expert studies have shown that, if 70% of sales or more is generated in different regions (15 to 20 countries) of the world, a company would be much more crisis-resistant towards any future international challenges.

Mature home markets, currency fluctuation problem, emerging new technologies, changing distribution channels, can result in less revenue in core markets, a further reason why modern companies are striving to enter Emerging Markets, often by M&A activity. There is a huge potential for company and revenue growth in such markets, and if conducted with enough market knowledge, these expansions can lead to significant increase in sales and in this way makes your business less dependent from the home market.

Targeting Emerging markets is becoming more popular, due to their high current and future market growth rate, the growth of middle classes with disposable incomes, and aging populations—all of which contribute to the huge number of potential customers.

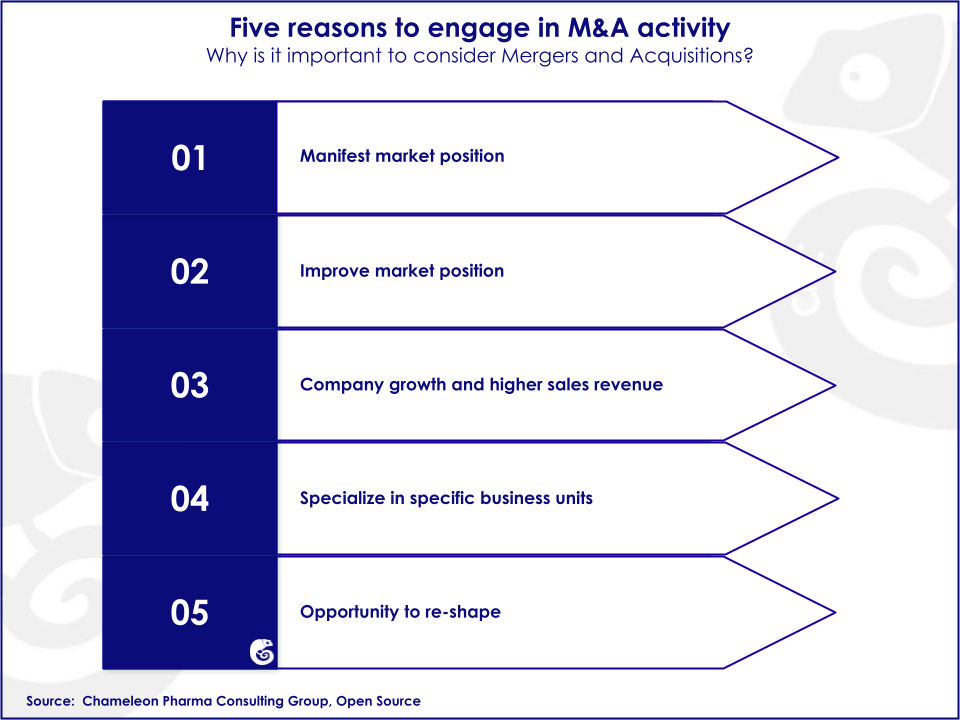

The Benefits of Selling and Purchasing Companies?

All of the challenges faced by the pharma industry lead to an increase in M&A activity. Pharma M&A’s pose an opportunity not only for the purchasing company but often for the selling company as well. Both corporations have the chance to remold themselves and set new core units. As a result, they gain the ability to specialize in certain segments in the hope of re-filling their product pipelines. The purchasing company might increase their sales revenue and reinvest the extra revenue, and the selling company will concentrate their investments and specialize in fewer or smaller units.

In emerging markets, local companies can benefit from the knowledge and experience of the purchasing company, and the investor can utilize local knowledge and facilitate market entry.

Companies can also benefit from each other’s knowledge and opportunities when they merging, which presents a prosperous opportunity in Emerging Countries.