Image by freepik

The EU medical device market is the second-largest in the world, forecasted to grow to approximately USD 335,36 bln by 2040 at a 4,09% CAGR. With over 500.000 types of medical devices available, international companies eyeing the European medical device market will find lucrative opportunities in this diverse and innovative landscape.

Growth and Key Market Trends in the European (EU) MD market

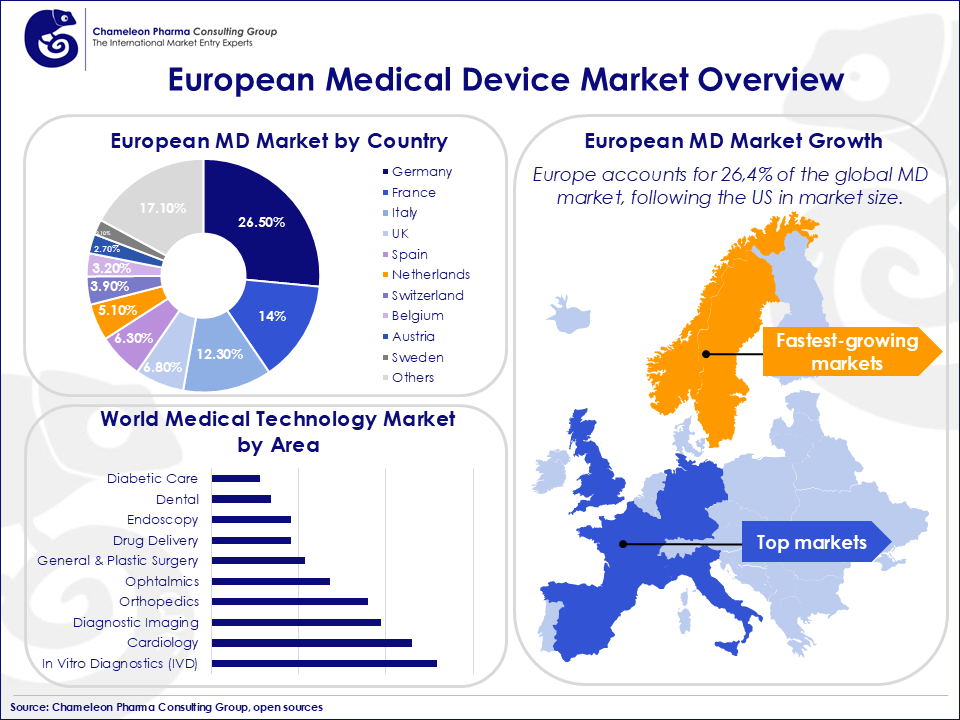

The European medical technology market is the second largest globally, accounting for 26,1% of the world market after the United States. Major markets in Europe include Germany, France, the United Kingdom (now not part of EU), Italy, and Spain, which together drive a substantial portion of the market demand. These countries are also hubs for innovation, particularly in vitro diagnostics (IVD), cardiology, and diagnostic imaging—the largest sectors within medical technology.

In recent years, Scandinavian countries have emerged as key growth regions, with Sweden leading the way, particularly in cardiology and orthopedic devices. Norway stands out for its high medical device spending per capita, creating further opportunities for entry.

The European medical device market is characterized by continuous innovation in medical devices, driven by advances in digital health, personalized medicine, and surgical technologies. The patient care medical devices segment, including critical care and diagnostics tools, shows significant growth, particularly in the post-COVID landscape.

Technological advancements in AI, 3D printing, and robotic surgery are propelling growth. With an average R&D investment rate of 8%, European manufacturers are at the forefront of innovation in medical devices.

Figure 1. European Medical Device Market Overview

MD Players in Europe are small/medium sized companies

More than >92% of the European Medical Technology Market is led by smaller MD companies with niche products, difficult to make products, good customer service, innovations, MD & drug combinations etc. Many of those smaller MD companies grow by cooperation with products and technology from other countries. It is a very good idea to systematically identify the best fitting SMEs in MD for your products regarding distribution/imported to Europe.

Some bigger players dominating the European market with standard MD products include Medtronic, GE, Siemens Healthcare, and Philips, all of which have established a strong presence due to robust R&D investments and strategic product launches. Other notable medium-sized companies include Fresenius Medical Care and Smith+Nephew, which are expected to lead the market due to their strong distribution networks and partnerships.

Innovation is central to growth in the European market, with companies investing in surgical robotics, 3D printing, and digital health solutions. For instance, robotic systems like the da Vinci Surgical System are gaining traction, offering precise, minimally invasive procedures. Advances in 3D printing are enabling the production of custom medical devices such as implants and prosthetics, further driving market expansion.

Opportunities and Strategic Considerations for International Companies

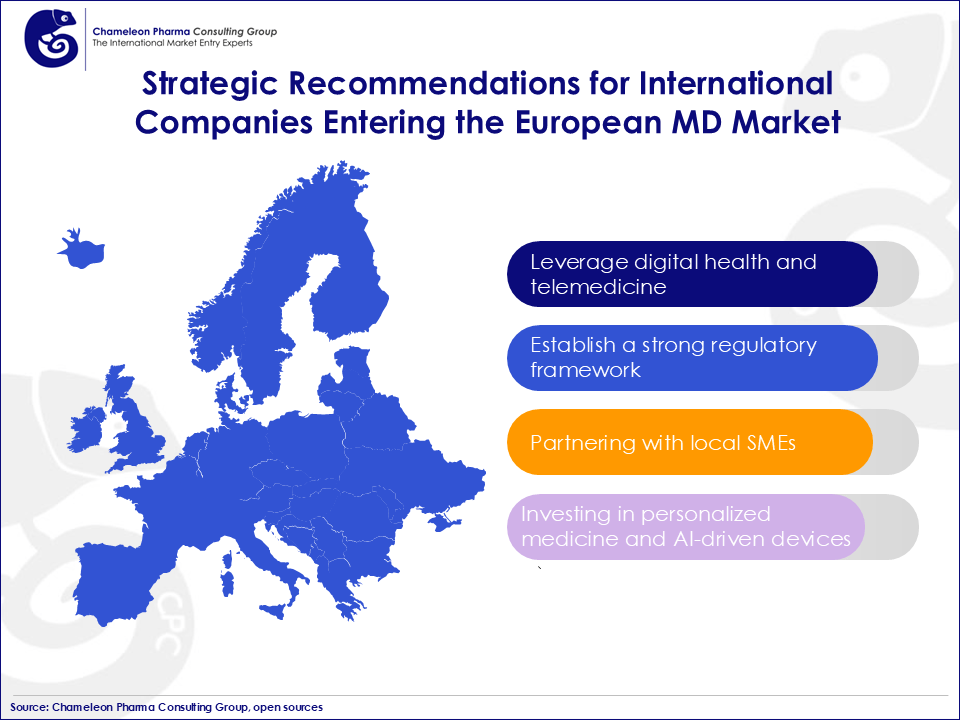

Figure 2. Strategic Recommendations for International Companies Entering the European MD Market

- The rise of digital health and telemedicine, projected to reach USD 32,3 billion by 2030, presents lucrative opportunities for companies investing in AI, IoT, and machine learning technologies to enhance patient care. In addition to major markets like Germany, France, and Italy, growing markets in Scandinavia, particularly Sweden and Norway, offer growth potential in diagnostic and orthopedic devices due to high healthcare spending.

- Establishing a strong regulatory framework is crucial for navigating challenges in medical device regulation and achieving medical device certification in the EU. Partnering with local regulatory experts like Chameleon Pharma Consulting Group can expedite this process and mitigate risks related to the EU MDR compliance.

- Partnering with local SMEs, which make up 92% of the industry, can help international companies leverage local market expertise.

- Investing in personalized medicine and AI-driven devices will further solidify positioning, while a detailed competitive analysis of the European market can help differentiate new entrants from established players like Medtronic or Siemens.

In conclusion, the European market growth for medical devices presents immense opportunities, but successful entry requires a solid understanding of EU MDR regulations, a focus on innovation in medical devices, and a well-defined medical device business development strategy. As the sector continues to evolve, those who invest in R&D and adapt to European healthcare market trends will lead the way in shaping the future of medical technology.

At Chameleon Pharma Consulting Group (CPC), we are dedicated to facilitating your market entry and expansion across promising regions like Latin America, Europe, Asia, the US/Canada, the Middle East, and CEE/CIS. Our comprehensive services—including market entry strategies, acquisitions, licensing, systematic international partner searches, and regulatory and EU MDR guidance—are designed to streamline your path to success. Embrace the opportunities ahead with CPC as your trusted partner, and together we can accelerate your global growth journey. To explore how CPC can support your business growth through innovative strategies, contact us at service@chameleon-pharma.com.