Image by Oleksii Liskonih from Getty Images Pro, Canva

Foreign investors and global companies understand the importance of crafting tailored strategies that seamlessly navigate a market’s unique structure, registration, distribution networks, and patient behaviors when entering new regions. Leveraging this approach, CPC’s latest insights into the Latin American market reveal lucrative growth opportunities, unlocking new potential for strategic expansion.

Growth Potential in Brazil OTC & Pharma Market

Brazil’s pharma market is the largest in Latin America, with an expected annual growth rate of 8.19%, forecasted to reach USD 77 billion by 2040. This growth is driven by a solid demand for both Rx and OTC drugs. The OTC segment is projected to grow more rapidly, with a 10% CAGR, indicating a strong patient preference for self-care options and preventive healthcare products.

Fig. 1 – Key Insights into Brazil’s OTC Market

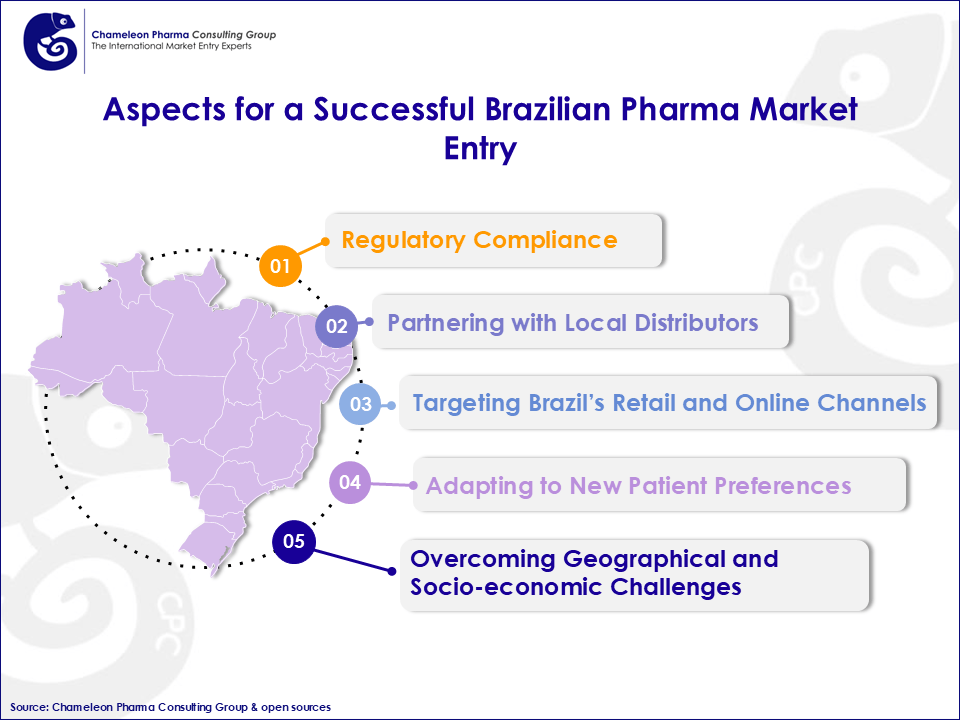

What We Recommend: Key Considerations for Successful Market Entry

-

Regulatory Considerations

Entering Brazil requires navigating its regulatory framework, primarily governed by ANVISA (Agência Nacional de Vigilância Sanitária), Brazil’s health surveillance agency. In October this year, the government adopted new policies and updates to streamline registration, especially for food supplements registration, offering a quicker route for companies with products that can qualify under this category. The process of supplement classification is simpler and more cost-effective, reducing regulatory burdens and offering a faster market entry pathway. New documents and checklists such as the updated Normative Instruction and guidelines on Regulatory Reliance can be received from CPC. Just ask us.

-

Partnering with Local Distributor Companies

An effective market penetration strategy into the Brazilian pharma market, especially for OTC drugs and Food Supplement products, is to establish a local partnership. Several benefits include leveraging local companies’ established network, such as key pharmacy chains, doctors, and healthcare facilities. This way international investors will also benefit from the facilitation of faster access to retail channels, which is pivotal for product visibility and sales. Brazil has a robust manufacturing sector, with Eurofarma and União Química as the two most known and largest pharma owners. Other key Brazilian manufacturers are Grupo NC, Hypera Pharma, Ache.

-

Targeting Brazil’s Retail and Online Channels

Brazil’s pharma distribution channels are dominated by retail pharmacies, private hospitals, and a growing online market. The retail sector, responsible for about 58.7% of total pharma sales, is a key driver in the market. Additionally, e-commerce channels are rapidly expanding, driven by patient demand for convenience and competitive pricing. Leading online pharmacies like Droga Raia and platforms such as offer direct access to patients, particularly in urban areas, and are vital for any company looking to scale digitally in Brazil.

Fig. 2 – Points to consider for Brazil’s Pharma Market Entry

Other key considerations for Brazil Rx & OTC market

-

Adapting to Patient Preferences

Patients have shown an increasing preference for high-quality, science-backed products. As awareness grows, products marketed with scientific endorsements and high-quality sourcing (such as “Made in EU”) are still viewed as more trustworthy, helping foreign brands position themselves advantageously.

-

Overcoming challenges

The country’s vast geography and socio-economic diversity create challenges in reaching rural and lower-income areas, where healthcare access can be limited. Companies should consider collaborating with non-profits, healthcare providers, or public health initiatives to improve outreach. Additionally, northwest region of Brazil boast potential in M&A market entry, especially for medium to large size pharma companies.

Conclusion

Brazil offers a wealth of opportunities for foreign investors seeking to enter its thriving pharma market, particularly in the rapidly expanding OTC, Phyto and self-care sectors. By navigating regulatory frameworks, forming strategic local partnerships, and leveraging both retail and online distribution channels, companies can successfully tap into this high-growth market and unlock its full potential.

At Chameleon Pharma Consulting Group (CPC), we are dedicated to facilitating your market entry and expansion across promising regions like Latin America, Europe, Asia, the US/Canada, the Middle East, and CEE/CIS. Our comprehensive services—including product & market analysis, international partner search, acquisitions, licensing, and regulatory and GMP guidance—are designed to streamline your path to success. Embrace the opportunities ahead with CPC as your trusted partner, and together we can accelerate your global growth journey. To explore how CPC can support your business growth through innovative strategies, contact us at service@chameleon-pharma.com.