Photo by Mara Rivera on Unsplash

The Philippines’ healthcare market is characterized by a steadily growing and aging population, solid healthcare expenditure, and high demand for diverse medical services. These trends present opportunities for Consumer Health and pharma markets.

The Philippines Pharma Market Characteristics

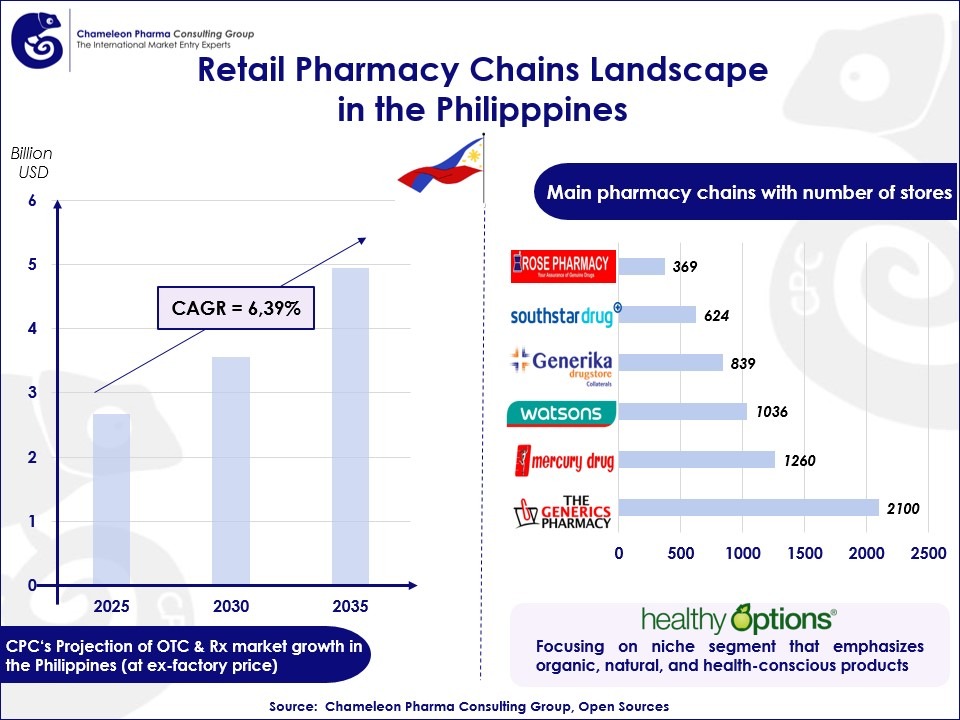

The Philippine population is estimated to reach 112.8 million by 2025, with a median age of 25.7 years. The country is also experiencing a rapid increase in life expectancy, which is now at 71.6 years. The total self-medication & prescription sales in the Philippines are projected to surpass US$ 5 billion in 2035, with a CAGR of 6.39%. This indicates significant market potential with an increased demand for healthcare products and services aimed at chronic and age-related health conditions.

A noteworthy characteristic of the Philippine pharma & consumer health market is the small pack design. Apart from the described medicines with fixed dosages, the normal pack size of OTC/FS and Rx products is between 8 and 15 tablets/sachets. For larger product presentations, consumers have the option to buy the full box or a certain number of pills as per their demand.

Due to this feature, the Philippine FDA requires pharma manufacturers to indicate necessary information (e.g., ingredients, lot number, expiring date…) on each tablet/sachet. In the case of food supplements without a claim, it is mandatory to include the statement “No approved therapeutic claims” on the local package.

Retail business: pharmacy chains in the Philippines

The distribution model in the Philippines is mainly dominated by pharmacy chains. They have grown massively thanks to the use of an easy franchise system. Former independent retail pharmacies could easily transform their disorganized stores into trusted points of sale with the support of the brands to which they converted.

The Generics Pharmacy (TGP) is the largest pharmacy chain in the Philippines, followed by Mercury Drug. Together, these two companies account for more than 60% of the market share. These chains play a vital role in dispensing prescription medicines to Filipino patients. Mercury Drug also offers certain discounts for senior citizens, along with a priority line for them in the stores. Other growing players in the retail pharmacy sector include Watsons, Generika, South Star Drug, and Rose Pharmacy.

Noticeably, the market is witnessing a shift in consumer preferences towards health and wellness supplements with the introduction of Healthy Options. These boutique-style stores focus on a niche segment that emphasizes organic, natural, and health-conscious products. This trend may encourage traditional pharmacies to expand their offerings in the health and wellness segment to capture this growing market.

Figure 1. The Retail Pharmacy Chaind Landscape in the Philippines

How can Chameleon Pharma Consulting Group support you expand your business in the Philippines?

With our extensive experience and strong network throughout 300+ projects, we are delighted to work with you in developing your expansion strategies in Asia and the Philippines. We offer:

- Systematic Country and Product analysis (Portfolio Analysis),

- Systematic Local Partner Identification,

- Registration and Regulatory Affairs.

Contact us today!