Discover Mexico and its huge potential now

Mexico is one of the Emerging Markets of the world. Geographically, it lies in Latin America, which contains numerous Emerging Markets. Yet it is so significant that it deserves particular attention.

The Market

The Mexican pharma market is developing rapidly. It is one of the leading markets in Latin America and one of the largest markets in the world.

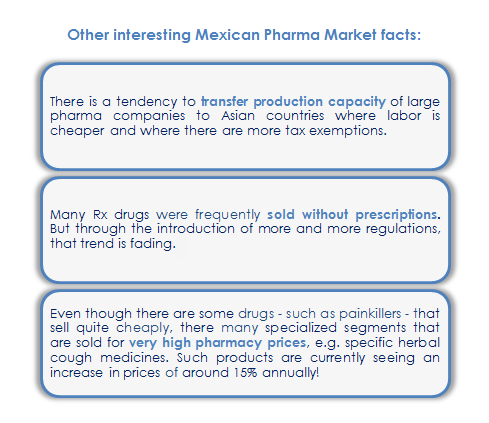

Mexico’s market size is estimated to be US dollars 22.5 billion by 2020 and the market has seen and continues to see annual growth rates of about 6%.

There are about 186 pharma firms in Mexico and about 650-750 Consumer Health companies. The number of employees in the pharma industry is more than 65 thousand. Mexico regularly introduces new developments in the field of drugs.

About 90% of Mexico’s pharmaceutical production is destined for the domestic market. Mexico has signed a large number of Free Trade Agreements (with more than 30 countries: Canada, USA, Japan, Israel and others).

Emerging Market power

Outside of NAFTA, the Mexico pharma market is taking full advantage of the emerging economic power of India, and the Indian pharma industry is increasing its presence within Mexico.

India has invested greatly in Mexico, with giant Indian pharmaceutical companies such as Ranbaxy Laboratories and Wockhardt Limited leading the way in the expansion of generic drugs in Mexico. Today, India holds the largest portion of generic drug manufacturing in Mexico and also exports Ayurveda.

Healthcare has been a top priority in Mexico for the last ten to twelve years, with the government working hard to keep its promise of universal coverage and increased hospital and medical infrastructure throughout the whole country.

The healthcare system

Mexico provides an outstanding example of what can be achieved through high-level political commitment.

Public domain

There are three major institutions in the Mexican healthcare system:

- The Mexican Institute of Social Security (IMSS): This is the largest social security institution in Latin America. It covers all formal workers in the private sector.

- The Institute of Health and Social Services: It covers all government workers and represents around 10% of the total population.

- “Seguro Popular” was created as a type of public insurance scheme to provide health service coverage for Mexicans not affiliated with any social security institution. This insurance scheme has been the main driver for increased public health coverage, and the government recently pledged that approximately 80% of state-purchased medicines should be comprised entirely of generic drugs.

The improvements of the regulatory environment as well as the increase in foreign direct investment make Mexico’s pharmaceutical market more attractive to multinational drug makers.

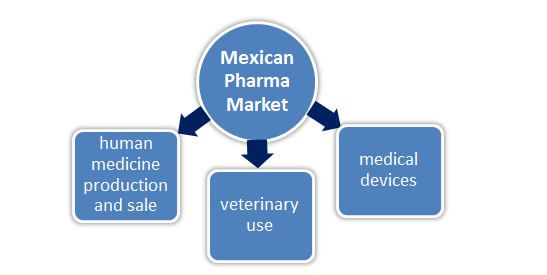

The Mexican pharma market can be divided into different segments:

Almost 60% of all manufactured drugs are generics and their share is growing. Source: CPC

Market regulations

In recent years the market has been more strictly regulated. In particular, the Mexican Federal Commission for Protection against Health Risks has recently suspended the registration of more than six thousand drugs. As a result, the interests of the companies that produce innovative products have been seriously affected. There is an even more difficult situation in the biotechnology sector, which is now in the midst of a chaotic transition–old standards are no longer valid and new ones are still in the process of development.

It is necessary to mention that Mexico works the same way as European countries: Medicines are supplied to pharmacies by 2-3 major distributors. But the role of distributors in the Mexican pharma market has been gradually reduced, and the distributors’ functions are being taken over by large pharmacy chains. Pharmaceutical companies are also interested in selling without intermediaries. Incidentally, this has a very positive impact on the cost of drugs for the end user.

At the same time, Mexican authorities are actively fighting against the fact that demand in Mexico is determined solely by the consumer and that pharmacies, for the sake of competitiveness, offer products at prices even lower than those set by the government.

This is the reason for the recent introduction of a number of restrictions on the activities of pharmacies. And today even tourists recognize that to buy a drug without a prescription in a Mexican pharmacy is impossible, although it was normal a few years ago.

Mexico is almost the only country where pentobarbital–used for euthanasia–is available and legally sold in drugstores. Information on this has generated a wave of pilgrims who travel to Mexico for lethal means for the elderly. The most popular cities for the supporters of euthanasia are Tijuana, Nuevo Laredo and Juarez, located near the US border.

The Mexican pharmacy business attracts more and more foreign investors. And those who enter the Mexican Pharma Market with care and local knowledge will be the most successful players in one of the world’s largest economies.

Chameleon Pharma Consulting

has a long-standing network and has extensive experience based on many projects in Mexico. We operate in various global industry segments, such as Consumer Health Care, Medical Devices, Rx, OTC and Cosmetics. We are happy to help you with your international strategy and are here to assist your market entry into the Mexican Pharma Market.