Consumer Health and Pharma M&A and Licensing

To achieve growth from their own products is not a realistic strategy for consumer health and pharma companies. M&A and Licensing will be more and more important for achieving international growth.

- In last years, the pharma and OTC industry has gone through a huge wave of M&As. In the 1980s, we saw the industry becoming more concentrated with the ten biggest pharma and consumer health companies accounting for about 10% of sales worldwide. In 2002, these top ten firms contributed to almost 45% of sales. The main reason for this concentration was the numerous M&A acts being conducted then.

- Now, self-medication and pharma companies are facing various challenges, such as the shrinking pharmaceutical pipeline, rising costs for R&D, and the marketing and commercialization of new products. New demands within the pharma and consumer health market are also complicated: it is getting more difficult to achieve higher pricing for new drugs and medicines. All these factors combined are influencing M&A activities and making them more complex.

- Well-thought-out licensing strategies have never been more important to the industry. Licensing is playing a vital role in companies’ business plans. Due to declining R&D productivity, limitations of healthcare costs, and the increasing threat of generic competition, pharma and OTC companies are forced to develop and adopt a successful license strategy to help them remain competitive in the future.

- Many international companies of different sizes and from different parts of the world trust us and rely on our advice. We are supporting international clients on:

-

- M&A projects and Due Diligence processes

- Identification of a product and company acquisition target

- Reviewing international business and expansion plans

- Evaluation of in- and out-licensing opportunities for Pharma and Consumer Health products in Emerging Markets

- Scenario planning during M&A and post mergers

- Our experts have extensive experience in assisting OTC, Food Supplement, Cosmetic, Medical Device, and Pharma companies in all phases of Licensing and M&A strategy development and implementation. We have supported many clients to identify acquisition targets in Mexico, China, the EU region, Poland, US/Canada, Thailand, Russia, Philippines, Poland, Brazil, Colombia, and more. We have also conducted numerous Due Diligence and M&A projects in the European, North & Latin American, and Asian markets.

Systematic Acquisition Process in OTC and Pharma

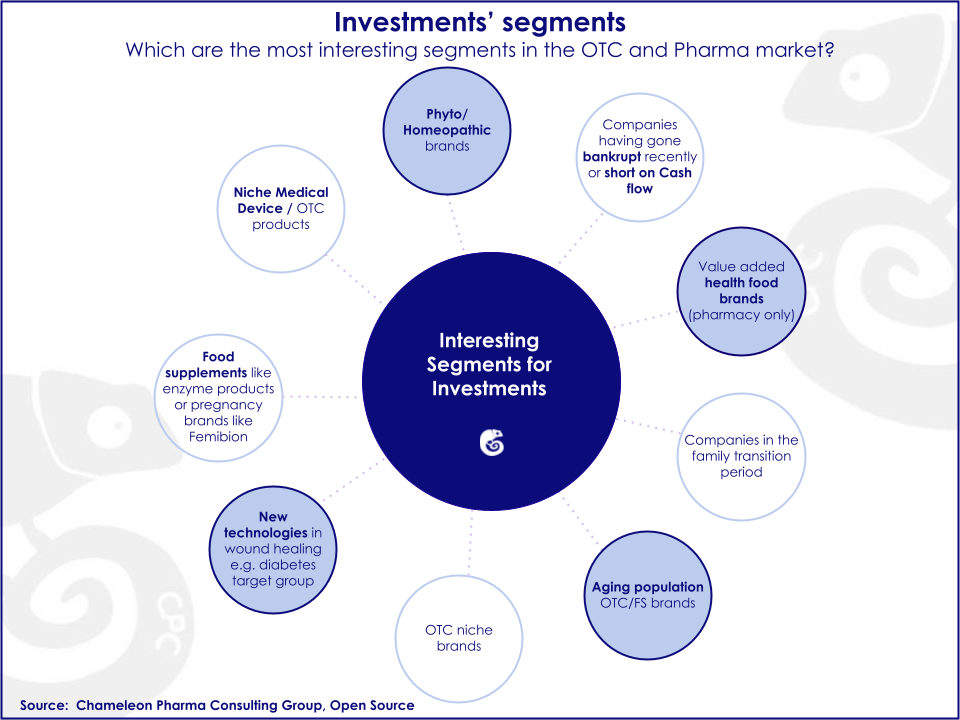

Among the numerous services that CPC offers we would like to introduce our systematic search for acquisition targets (SAT). Due to the rapid and large-scale development of the Consumer Health and Pharma sector in Emerging Markets, they have become a new horizon for Investors. However, this does not mean that we should eliminate developed markets in the EU, Japan, the US, and Canada – merger and acquisition processes are happening all over the world.

Why should you choose Chameleon Pharma Consulting?

- Experience – over 25 years of networking experience with shareholders and owners in Emerging Markets, US/Canada, and Europe and working on local and international projects.

- We are able to identify targets before any bank or M&A company offers them. This gives our clients the first-mover advantage and the first rights to acquire interesting companies or products.

- Knowledge – access to OTC, Medical Device, Rx, Food Supplement, and Derma/Cosmetic channels from both local and international sources that go way beyond any market data.

- We know which targets will be a good fit for you due to our commercial and regulatory expert know-how

- Hands-on approach – we focus on pragmatic implementation.

Despite being so prevalent, M&A processes are not easy to carry out. Consumer Health, FS, MD, Cosmetic, and Pharma companies’ products and brands show fantastic future profitable growth potential, which makes them a target for numerous investors. When several investors start bidding for the same target, acquisition prices rocket up quickly. The most alluring targets are sold for a high multiple that often does not justify the current sales of the target, and bidding against multinational companies is sometimes futile since they are prepared to pay a premium for some companies/brands.

With our assistance you can avoid:

- Idle bidding processes: we can help you get targets on the table before anyone else

- Loss of time and money: we will review the same targets everyone does

- Paying too much by looking at targets from data bases or banks commonly chosen by everyone

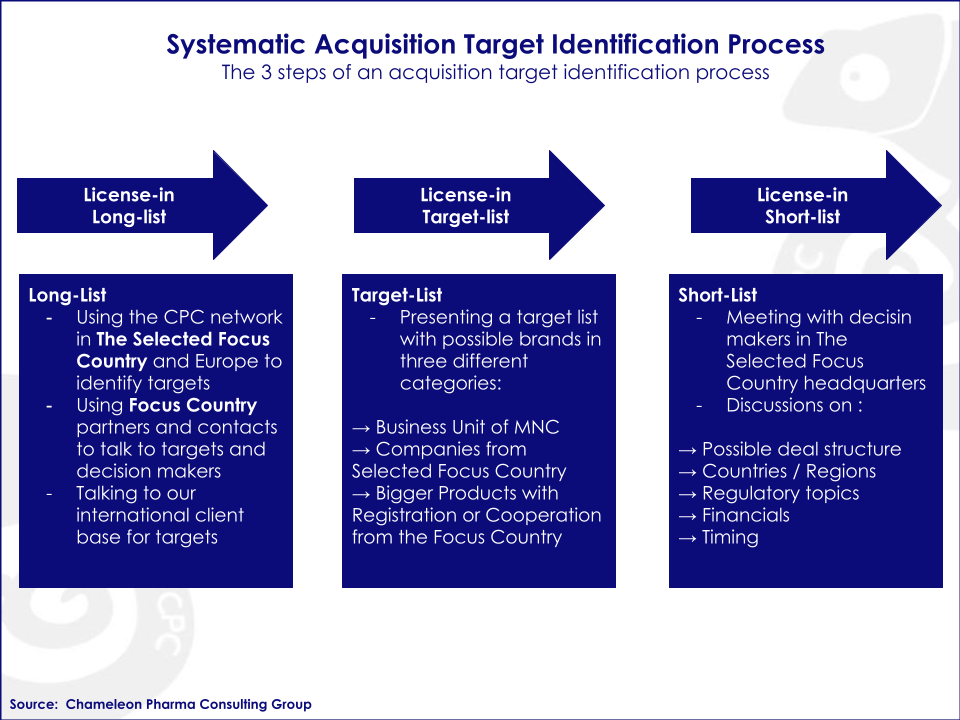

Our Systematic Approach

- Detailed market analysis of several potential targets (so-called Long-List Report)

- Personal discussions with key targets (Target-List Report)

- The last stage of evaluation and discussions brings a summary report on the final targets (Short-List Report) including business cases.

Each stage is followed by the delivery of clear and detailed reports and feedback to our client. In addition to these steps, we gladly offer our assistance in pre- and/or due diligence meetings, negotiation processes, business forecasts, and purchase contracts.